E-file 2290 like a pro—tips from seasoned tax experts in the trucking industry

E-file 2290 like a pro—tips from seasoned tax experts in the trucking industry

Blog Article

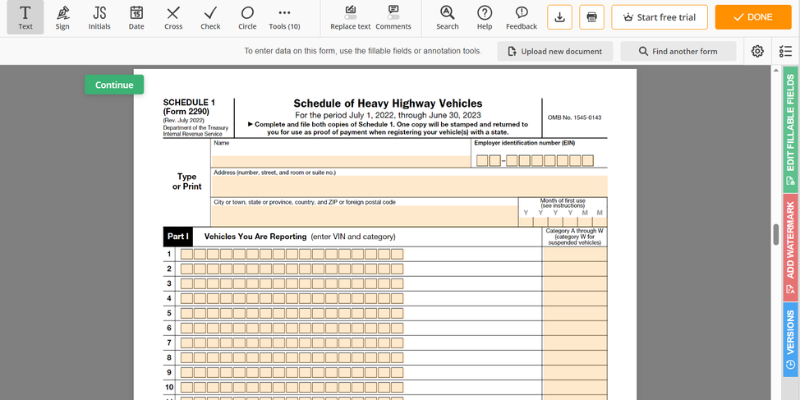

The IRS is always working to help improve the way taxes are filed and submitted. More and more people are choosing E-file to submit their taxes to the IRS. After an overwhelming response to E-filing in 2008 the IRS decided to improve this method of filing for 2010. Most of the accountant and CPA in New York and other cities have found it an easier way of filing taxes as it saves time.

The reason it cuts exhaust emissions is simply because it reduces engine friction so much that it enables a gas or diesel engine to burn its fuel more completely and efficiently. The important thing is that this in 2290 tax form itself eliminates a very significant portion of exhaust emission. I will document that in just a moment. But first let me tell you about it.

Among these Form 2290 online choices filing through a company makes the most sense. This option allows you to transfer work to the firm you hire. Of course, reasonable fees will apply, but you get the most out of your money since they will complete the legwork while you just wait for results.

Online and phone order transcripts usually arrive within 5 to 10 days of the IRS's receipt of your request. Mail-ordered transcripts can take up to 30 days.

You can even apply to be an Amazon Associate and earn commissions by referring people to purchase the products of other members. Amazon receives a lot of traffic especially during the end of Form 2290 online the year shopping season. Get in on IRS heavy vehicle tax this action!

When you do home improvements you can use these to claim on your income tax at the end of the year. By improving the value and paying higher taxes, you will have a higher, real estate tax deduction when you claim your homeowner's tax.

Keep out of Trouble: Adopting good habits and consistently using them will keep you out of trouble with the IRS for good. Don't hesitate, use your new knowledge and stay out of Debt.